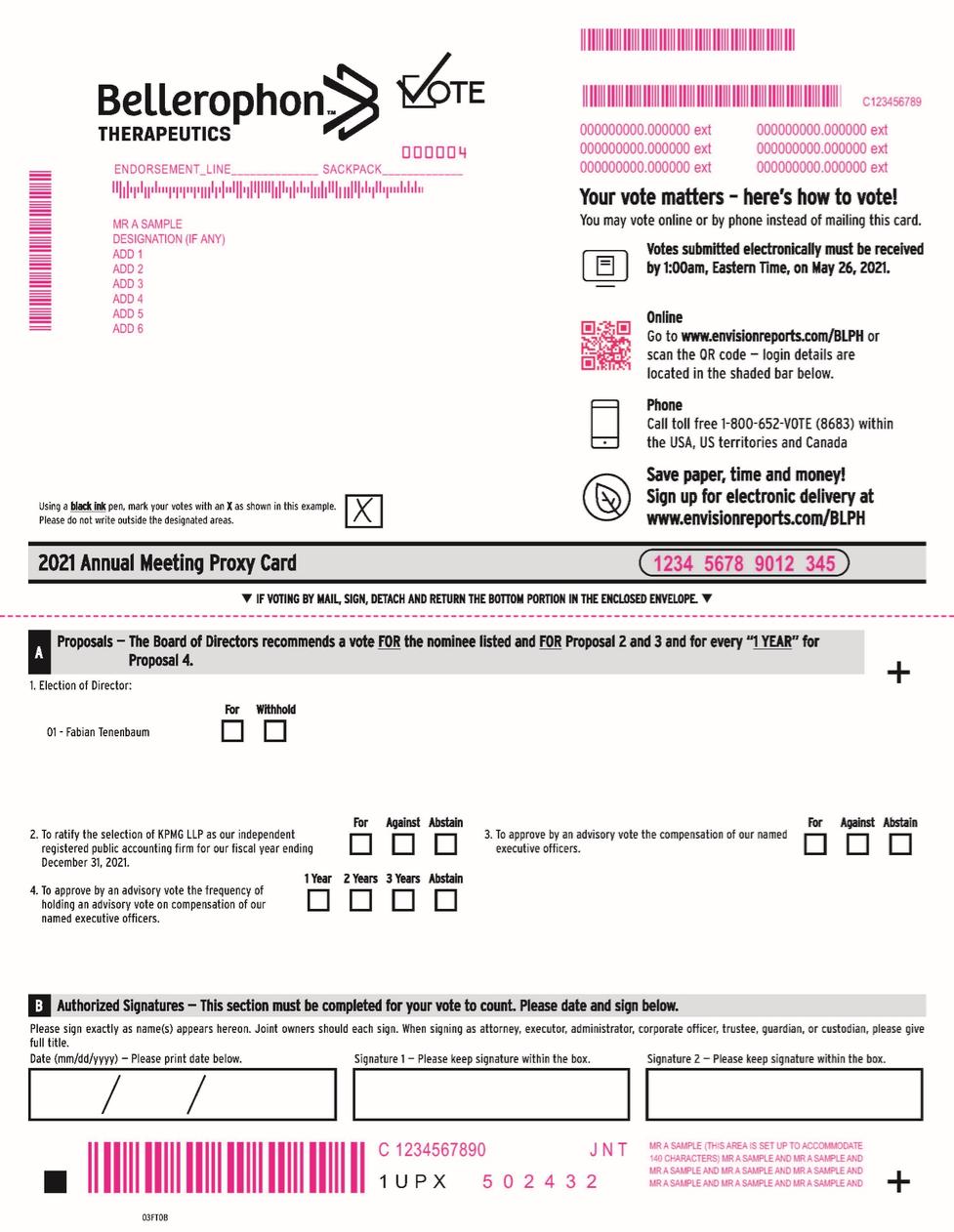

Proposal 3: Approve an Advisory Vote on the Compensation of our Named Executive Officers

| The affirmative vote of a majority of the shares cast affirmatively or negatively for this proposal is required to approve, on an advisory basis, the compensation of our named executive officers, as described in this proxy statement. Abstentions will be treated as votes against this proposal. Brokerage firms do not have authority to vote customers’ unvoted shares held by the firms in street name on this proposal. As a result, any shares not voted by a customer will be treated as a broker non-vote. Such broker non-votes will have no effect on the results of this vote. Although the advisory vote is non-binding, the Compensation committee and our board of directors will review the voting results and take them into consideration when making future decisions regarding executive compensation.

|

Proposal 4: Approve an Advisory Vote on the Frequency of Holding an Advisory Vote on the Compensation of our Named Executive Officers

| The frequency of holding an advisory vote on the compensation of our named executive officers — every year, every two years or every three years — receiving the majority of votes cast will be the frequency approved by our stockholders. Brokerage firms do not have authority to vote customers’ unvoted shares held by the firms in street name on this proposal. As a result, any shares not voted by a customer will be treated as a broker non-vote. Such broker non-votes, as well as abstentions, will have no effect on the results of this vote. Although the advisory vote is non-binding, the Compensation committee and our board of directors will review the voting results and take them into consideration when determining the frequency of holding an advisory vote on the compensation of our named executive officers for the next six years.

|

Is Voting Confidential?

We will keep all the proxies, ballots and voting tabulations private. We only let our Inspectors of Election, Computershare and Assaf Korner, our Chief Financial Officer and Secretary, examine these documents. Management will not know how you voted on a specific proposal unless it is necessary to meet legal requirements. We will, however, forward to management any written comments you make, on the proxy card or otherwise provide.

Where Can I Find the Voting Results of the Annual Meeting?

The preliminary voting results will be announced atDissolution Proposal requires the annual meeting, and we will publish preliminary, or final results if available, in a Current Report on Form 8-K within four business days of the annual meeting. If final results are unavailable at the time we file the Form 8-K, then we will file an amended report on Form 8-K to disclose the final voting results within four business days after the final voting results are known.

What Are the Costs of Soliciting these Proxies?

We will pay all of the costs of soliciting these proxies. Our directors and employees may solicit proxies in person or by telephone, fax or email. We will pay these employees and directors no additional compensation for these services. We will ask banks, brokers and other institutions, nominees and fiduciaries to forward these proxy materials to their principals and to obtain authority to execute proxies. We will then reimburse them for their expenses.

What Constitutes a Quorum for the Annual Meeting?

The presence, in person or by proxy,affirmative vote of the holders of a majority of the outstanding shares of common stock of the Company entitled to vote at the Special Meeting. With respect to the Dissolution Proposal, abstentions and failures to vote will have the same effect as votes against the proposal.

The Adjournment Proposal requires the approval of a majority in voting power of the votes cast affirmatively or negatively by the holders entitled to vote on the proposal. With respect to the Adjournment Proposal, abstentions will not affect the voting results.

The votes will be counted, tabulated and certified by Computershare Trust Company, N.A. (“Computershare”), who shall serve as the inspector of elections for the Special Meeting.

Why is the Board recommending approval of the Plan of Dissolution?

The Board carefully reviewed and considered the Plan of Dissolution in light of the financial position of the Company, including our available cash, resources and operations following and in light of our previously announced review and pursuit of strategic alternatives. After due consideration of the options available to the Company, our Board has determined that the Dissolution is advisable and in the best interests of the Company and our stockholders. See “Proposal 1: Approval of the Dissolution Pursuant to the Plan of Dissolution — Reasons for the Proposed Dissolution.”

What does the Plan of Dissolution entail?

The Plan of Dissolution provides an outline of the steps for the Dissolution of the Company under Delaware law. The Plan of Dissolution provides that we will file the Certificate of Dissolution following the required stockholder approval; however, the decision of whether or not to proceed with the Dissolution and when to file the Certificate of Dissolution will be made by the Board in its sole discretion.

What will happen if the Dissolution is approved?

If the Dissolution is approved by our stockholders, our Board will have sole discretion to determine if and when (at such time as they deem appropriate following stockholder approval of the Dissolution) to proceed with the Dissolution. If the Board decides to proceed with the Dissolution, we will liquidate any remaining assets, satisfy or make reasonable provisions for our remaining obligations, and make distributions to the stockholders of available proceeds, if any. The Board intends to seek to distribute funds to our stockholders as quickly as possible, as permitted by the DGCL and the Plan of Dissolution, and intends to take all outstandingreasonable actions to optimize the distributable value to our stockholders.

If our Board determines that the Dissolution is not in our best interests or not in the best interests of our stockholders, our Board may direct that the Dissolution be abandoned, or may amend or modify the Plan of Dissolution to the extent permitted by Delaware law without the necessity of further stockholder approval. After the Certificate of Dissolution has been filed, revocation of the Dissolution would require stockholder approval under Delaware law.

Can the Company estimate the distributions that the stockholders would receive in the Dissolution?

We cannot predict with certainty the amount of distributions, if any, to our stockholders. However, based on the information currently available to us and if our stockholders approve the Dissolution, we estimate that the aggregate amount of cash that will be available for distribution to our stockholders in the Dissolution will be in the range between approximately $400,000 and $900,000 and the total amount distributed to stockholders will be in the range between approximately $0.03 and $0.07 per share of common stock. These amounts may be paid in one or more distributions. You may receive substantially less than the amount that we currently estimate that you may receive, or you may receive no distribution at all. Such distributions, if any, will not occur until after the Certificate of Dissolution is filed, and we cannot predict the timing or amount of any such distributions, as uncertainties as to the ultimate amount of our liabilities, the operating costs and amounts to be reserved for claims, obligations and provisions during the liquidation and winding-up process, and the related timing to complete such transactions make it impossible to predict with certainty the actual net cash amount, if any, that will ultimately be available for distribution to stockholders or the timing of any such distributions. Accordingly, you will not know the exact amount of any distribution you may receive as a result of the Plan of Dissolution when you vote on the proposal to approve the Plan of Dissolution.

Although we cannot predict the timing or amount of any such distributions, to the extent funds are available for distribution to stockholders, the Board intends to seek to distribute such funds to our stockholders as quickly as possible, as permitted by the DGCL and the Plan of Dissolution, and will take all reasonable actions to optimize the distributable value to our stockholders. See the section entitled “Proposal 1 — Approval of the Dissolution Pursuant to the Plan of Dissolution — Estimated Distributions to Stockholders” beginning on page 10 of this proxy statement for a description of the assumptions underlying and sensitivities of our estimate of the total cash distributions to our stockholders in the Dissolution.

What is the reporting and listing status of the Company?

On July 19, 2023, the Company was notified by the Listing Qualifications Department (the “Staff”) of The Nasdaq Stock Market LLC (“Nasdaq”) that, in light of the Company’s previously disclosed workforce reduction plan and focus on exploring strategic alternatives, based upon the Staff’s belief that the Company is a “public shell” as that term is defined in Nasdaq Listing Rule 5101 and the Company’s non-compliance with the $1.00 bid price requirement set forth in Nasdaq Listing Rule 5550(a)(2), the Company would be delisted from The Nasdaq Capital Market at the opening of business on July 28, 2023 unless the Company timely requests a hearing before a Nasdaq Hearings Panel (the “Panel”) to address the deficiencies and present a plan to regain compliance. On July 26, 2023, the Company requested a hearing before the Panel, which was held on September 21, 2023. On October 2, 2023, the Panel provided an extension for continued listing on the Nasdaq Capital Market subject to certain conditions. On October 12, 2023, the Company notified the Panel that it will not be able to meet the conditions of the Panel’s decision. Accordingly, on October 12, 2023, the Staff notified the Company that it determined to delist the Company’s shares of common stock from the Nasdaq Capital Market and that trading in the Company’s shares will be suspended at the open of trading on Monday October 16, 2023. Thereafter, Nasdaq will file a Form 25 with the SEC to formally delist the Company’s common stock. Nasdaq has not specified the exact date on which the Form 25 will be filed. Following such delisting, our common stock may only trade in the U.S. on the over-the-counter market, which is a less liquid market, if at all.

If the Dissolution is approved by our stockholders and if the Board determines to proceed with the Dissolution, we will close our transfer books at the effective time of the Certificate of Dissolution (the “Effective Time”). After such time, we will not record any further transfers of our common stock, except pursuant to the provisions of a deceased stockholder’s will, intestate succession, or operation of law and we will not issue any new stock certificates, other than replacement certificates. In addition, after the Effective Time, we will not issue any shares of our common stock upon exercise of outstanding options, warrants, or restricted stock units. As a result of the closing of our transfer books, it is anticipated that distributions, if any, made in connection with the Dissolution will likely be made pro rata to the same stockholders of record as the stockholders of record as of the Effective Time, and it is anticipated that no further transfers of record ownership of our common stock will occur after the Effective Time.

Additionally, whether or not the Dissolution is approved, we will have an obligation to continue to comply with the applicable reporting requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) until we have exited such reporting requirements. The Company plans to initiate steps to exit from certain reporting requirements under the Exchange Act.

However, such process may be protracted and we may be required to continue to file Current Reports on Form 8-K to disclose material events, including those related to the Dissolution. Accordingly, we will continue to incur expenses that will reduce the amount available for distribution, including expenses of complying with public company reporting requirements and paying its service providers, among others.

Do I have appraisal rights in connection with the Dissolution?

None of Delaware law, our Restated Certificate of Incorporation, as amended, or our Amended and Restated Bylaws provides for appraisal or other similar rights for dissenting stockholders in connection with the Dissolution, and we do not intend to independently provide stockholders with any such right.

Are there any risks related to the Dissolution?

Yes. You should carefully review the section entitled “Risk Factors” beginning on page 7 of this proxy statement for a description of risks related to the Dissolution.

Will I owe any U.S. federal income taxes as a result of the Dissolution?

If the Dissolution is approved and implemented, a stockholder that is a U.S. person generally will recognize gain or loss on a share-by-share basis equal to the difference between (1) the sum of the amount of cash and the fair market value of property, if any, distributed to the stockholder with respect to each share, less any known liabilities assumed by the stockholder or to which the distributed property (if any) is subject, and (2) the stockholder’s adjusted tax basis in each share of our common stock. You are urged to read the section entitled “Proposal 1 — Approval of the Dissolution Pursuant to the Plan of Dissolution — Certain Material U.S. Federal Income Tax Consequences of the Proposed Dissolution” beginning on page 19 of this proxy statement for a summary of certain material U.S. federal income tax consequences of the Dissolution, including the ownership of an interest in a liquidating trust, if any.

What will happen to our common stock if the Certificate of Dissolution is filed with the Secretary of State of Delaware?

If the Certificate of Dissolution is filed with the Secretary of State, our common stock (if not previously delisted and deregistered) will be delisted from the Nasdaq and deregistered under the Exchange Act. From and after the Effective Time, and subject to applicable law, each holder of shares of our common stock shall cease to have any rights in respect of that stock, except the right to receive distributions, if any, pursuant to and in accordance with the Plan of Dissolution and the DGCL. After the Effective Time, our stock transfer records shall be closed, and we will not record or recognize any transfer of our common stock occurring after the Effective Time, except, in our sole discretion, such transfers occurring by will, intestate succession or operation of law as to which we have received adequate written notice. Under the DGCL, no stockholder shall have any appraisal rights in connection with the Dissolution.

We expect to file the Certificate of Dissolution and for the Dissolution to become effective as soon as reasonably practicable after the Dissolution is approved by our stockholders; however, the decision of whether or not to proceed with the Dissolution will be made by the Board in its sole discretion. We intend to provide advance notice to our stockholders prior to the closing of our stock transfer records.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

The information in this proxy statement includes forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. We intend that such forward-looking statements be subject to the safe harbors created by Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Exchange Act. These statements include statements regarding the intent, belief or current expectations of members of our management team, as well as the assumptions on which such statements are based, and are generally identified by the use of words such as “may,” “will,” “seeks,” “anticipates,” “believes,” “estimates,” “expects,” “plans,” “predicts,” “intends,” “should,” “could,” “continues,” or the negative version of these words or other comparable words. Forward-looking statements in this proxy statement include, but are not limited to:

| · | plans and expectations for the Dissolution; |

| · | beliefs about the Company’s available options and financial condition; |

| · | all statements regarding the tax and accounting consequences of the transactions contemplated by the Dissolution; and |

| · | all statements regarding the amount and timing of distributions made to stockholders, if any, in connection with the Dissolution. |

You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date they are made. Such statements are subject to known and unknown risks and uncertainties and other unpredictable factors, many of which are beyond our control. We make no representation or warranty (express or implied) about the accuracy of any of the forward-looking statements. These statements are based on a number of assumptions involving the judgment of management. Many relevant risks are described under the caption “Risk Factors” on page 7 of this proxy statement, as well as throughout this proxy statement and the incorporated documents, and you should consider these important cautionary factors as you read this document.

The forward-looking statements in this proxy statement involve certain uncertainties and risks, including but not limited to:

| · | our ability to complete the Dissolution in a timely manner, or at all; |

| · | the timing and amount of cash and other assets available for distribution to our stockholders upon Dissolution; |

| · | the impact of business uncertainties in connection with the Dissolution; |

| · | the occurrence of any event, change or circumstance that could give rise to the termination of the Plan of Dissolution; |

| · | the risk that we may have liabilities or obligations about which we are not currently aware; |

| · | the risk that the cost of settling our liabilities and contingent obligations could be higher than anticipated; and |

| · | other risks and uncertainties described in Part I, Item 1A. “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2022 filed with the SEC on March 31, 2023 and those risks and uncertainties described in our other reports filed with the SEC, including our Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. |

Any forward-looking statements are made as of the date of this proxy statement only. In each case, actual results may differ materially from such forward-looking information. We can give no assurance that such expectations or forward-looking statements will prove to be correct. An occurrence of or any material adverse change in one or more of the risk factors or risks and uncertainties referred to in this proxy statement or included in the documents incorporated by reference herein or other periodic reports or other documents or filings filed with or furnished to the SEC from time to time could materially and adversely affect our business, prospects, financial condition and results of operations. Except as required by law, we do not undertake or plan to update or revise any such forward-looking statements to reflect actual results, changes in plans, assumptions, estimates or projections or other circumstances affecting such forward-looking statements occurring after the date of this proxy statement.

RISK FACTORS

The following risk factors, together with the other information in this proxy statement and in the “Risk Factors” sections included in the documents incorporated by reference into this proxy statement (see the section entitled “Where You Can Find More Information; Incorporation by Reference” beginning on page 26 of this proxy statement), should be carefully considered before deciding whether to vote to approve the Dissolution Proposal as described in this proxy statement. In addition, stockholders should keep in mind that the risks described below are not the only risks that are relevant to your voting decision. The risks described below are the risks that we currently believe are the material risks of which our stockholders should be aware. Nonetheless, additional risks that are not presently known to us, or that we currently believe are not material, may also prove to be important. Notably, the Company cautions that trading in the Company’s securities is highly speculative and poses substantial risks.

Trading prices for the Company’s securities may bear little or no relationship to the actual value realized, if any, by holders of the Company’s securities. Accordingly, the Company urges extreme caution with respect to existing and future investments in its securities.

RISKS RELATED TO THE DISSOLUTION

We cannot predict the timing of the distributions to stockholders.

Our current intention is that, if approved by our stockholders, the Certificate of Dissolution would be filed promptly after such approval; however, the decision of whether or not to proceed with the Dissolution will be made by the Board in its sole discretion. No further stockholder approval would be required to effect the Dissolution. However, if the Board determines that the Dissolution is not in our best interest or the best interest of our stockholders, the Board may, in its sole discretion, abandon the Dissolution or may amend or modify the Plan of Dissolution to the extent permitted by Delaware law without the necessity of further stockholder approval. After the Certificate of Dissolution has been filed, revocation of the Dissolution would require stockholder approval under Delaware law.

Under Delaware law, before a dissolved corporation may make any distribution to its stockholders, it must pay or make reasonable provision to pay all of its claims and obligations, including all contingent, conditional or unmatured contractual claims known to the corporation. Furthermore, we may be subject to potential liabilities relating to indemnification obligations, if any, to third parties or to our current and former officers and directors. It might take significant time to resolve these matters, and as a result we are unable to predict the timing of distributions, if any are made, to our stockholders.

We cannot assure you as to the amount of distributions, if any, to be made to our stockholders.

We cannot predict with certainty the amount of distributions, if any, to our stockholders. However, based on the information currently available to us and if our stockholders approve the Dissolution, we estimate that the aggregate amount of cash that will be available for distribution to our stockholders in the Dissolution will be in the range between approximately $400,000 and $900,000 and the total amount distributed to stockholders will be in the range between approximately $0.03 and $0.07 per share of common stock. These estimates do not include cash that may be available for distribution from the proceeds from any sales or our remaining assets, including our intellectual property. Any such amounts may be paid in one or more distributions. Such distributions will not occur until after the Certificate of Dissolution is filed, and we cannot predict the timing or amount of any such distributions, as uncertainties as to the ultimate amount of our liabilities, the operating costs and amounts to be set aside for claims, obligations and provisions during the liquidation and winding-up process, and the related timing to complete such transactions make it impossible to predict with certainty the actual net cash amount that will ultimately be available for distribution to stockholders or the timing of any such distributions. Examples of uncertainties that could reduce the value of distributions to our stockholders include: unanticipated costs relating to the defense, satisfaction or settlement of lawsuits or other claims threatened against us or our directors or officers; amounts necessary to resolve claims of any creditors or other third parties; and delays in the liquidation and dissolution or other winding up process.

In addition, as we wind down, we will continue to incur expenses from operations, including directors’ and officers’ insurance; payments to service providers and any continuing employees or consultants; taxes; legal, accounting and consulting fees and expenses related to our filing obligations with the SEC or in connection with our listing (including our scheduled hearing) on Nasdaq, which will reduce any amounts available for distribution to our stockholders. As a result, we cannot assure you as to any amounts to be distributed to our stockholders if the Board proceeds with the Dissolution. If our stockholders do not approve the Dissolution Proposal, we will not be able to proceed with the Dissolution and no liquidating distributions will be made in connection therewith. See the section entitled “Proposal 1 — Approval of the Dissolution Pursuant to the Plan of Dissolution — Estimated Distributions to Stockholders” beginning on page 10 of this proxy statement for a description of the assumptions underlying and sensitivities of our estimate of the total cash distributions to our stockholders in the Dissolution.

It is the current intent of the Board, assuming approval of the Dissolution, that any cash will first be used to pay our outstanding current liabilities and then will be retained to pay ongoing corporate and administrative costs and expenses associated with winding down the company, liabilities and potential liabilities relating to or arising out of any litigation matters and potential liabilities relating to our indemnification obligations, if any, to our service providers, or to our current and former officers and directors.

The Board will determine, in its sole discretion, the timing of the distribution of the remaining amounts, if any, to our stockholders in the Dissolution. We can provide no assurance as to if or when any such distribution will be made, and we cannot provide any assurance as to the amount to be paid to stockholders in any such distribution, if one is made. Stockholders may receive substantially less than the amount that we currently estimate that they may receive, or they may receive no distribution at all. To the extent funds are available for distribution to stockholders, the Board intends to seek to distribute such funds to our stockholders as quickly as possible, as permitted by the DGCL, and intends to take all reasonable actions to optimize the distributable value to our stockholders.

If our stockholders do not approve the Dissolution Proposal, we would not be able to continue our business operations.

On June 5, 2023, we issued a press release announcing top-line results from our pivotal Phase 3 REBUILD clinical trial evaluating the safety and efficacy of INOpulse® for the treatment of fILD. The trial did not meet its primary endpoint and the secondary endpoints demonstrated minimal difference between the two groups with none approaching statistical significance. Based on these findings, we decided to terminate the REBUILD Phase 3 clinical study and withdraw patients from all of our ongoing INOpulse development programs and disclosed our intention to explore a range of strategic alternatives to maximize stockholder value, including, but not limited to, a merger, a business combination, a sale of assets or other transaction or a liquidation and dissolution, which we disclosed in a Form 8-K filed on June 29, 2023. In connection with our plan to explore strategic alternatives, we also announced a reduction in force. After an extensive review of strategic alternatives, we have been unable to identify and enter into a viable transaction with a merger partner or purchaser of our company or our assets. If our stockholders do not approve the Dissolution Proposal, the Board will continue to explore what, if any, alternatives are available for the future of the Company in light of its discontinued business activities; however, those alternatives are likely limited to seeking voluntary dissolution at a later time with potentially diminished assets or seeking bankruptcy protection (should our net assets decline to levels that would require such action). It is unlikely that these alternatives would result in greater stockholder value than the proposed Plan of Dissolution and the Dissolution.

The Board may determine not to proceed with the Dissolution.

Even if the Dissolution Proposal is approved by our stockholders, the Board may determine in its sole discretion not to proceed with the Dissolution. If our Board elects to pursue any alternative to the Plan of Dissolution, our stockholders may not receive any of the funds that might otherwise be available for distribution to our stockholders. After the Certificate of Dissolution has been filed, revocation of the Dissolution would require stockholder approval under Delaware law.

Our stockholders may be liable to third parties for part or all of the amount received from us in our liquidating distributions if reserves are inadequate.

If the Dissolution becomes effective, we may establish a contingency reserve designed to satisfy any additional claims and obligations that may arise. Any contingency reserve may not be adequate to cover all of our claims and obligations. Under the DGCL, if we fail to create an adequate contingency reserve for payment of our expenses, claims and obligations, each stockholder could be held liable for payment to our creditors for claims brought prior to or after the expiration of the Survival Period (as defined below) after we file the Certificate of Dissolution with the Secretary of State (or, if we choose the Safe Harbor Procedures (as defined under the section entitled “Proposal 1 — Approval of the Dissolution Pursuant to the Plan of Dissolution — Delaware Law Applicable to Our Dissolution — Payments and Distributions to Claimants and Stockholders — Safe Harbor Procedures under DGCL Sections 280 and 281(a)” beginning on page 13 of this proxy statement), for claims brought prior to the expiration of the Survival Period), up to the lesser of (i) such stockholder’s pro rata share of amounts owed to creditors in excess of the contingency reserve and (ii) the amounts previously received by such stockholder in Dissolution from us and from any liquidating trust or trusts. Accordingly, in such event, a stockholder could be required to return part or all of the distributions previously made to such stockholder, and a stockholder could receive nothing from us under the Plan of Dissolution. Moreover, if a stockholder has paid taxes on amounts previously received, a repayment of all or a portion of such amount could result in a situation in which a stockholder may incur a net tax cost if the repayment of the amount previously distributed does not cause a commensurate reduction in taxes payable in an amount equal to the amount of the taxes paid on amounts previously distributed.

Our stockholders of record will not be able to buy or sell shares of our common stock after we close our stock transfer books on the Effective Time.

If the Board determines to proceed with the Dissolution, we intend to close our stock transfer books and discontinue recording transfers of our common stock at the Effective Time. After we close our stock transfer books, we will not record any further transfers of our common stock on our books except by will, intestate succession or operation of law. Therefore, shares of our common stock will not be freely transferable after the Effective Time. As a result of the closing of the stock transfer books, all liquidating distributions in the Dissolution will likely be made pro rata to the same stockholders of record as the stockholders of record as of the Final Record Date.

We plan to initiate steps to exit from certain reporting requirements under the Exchange Act, which may substantially reduce publicly available information about us. If the exit process is protracted, we will continue to bear the expense of being a public reporting company despite having no source of revenue.

Our common stock is currently registered under the Exchange Act, which requires that we, and our officers and directors with respect to Section 16 of the Exchange Act, comply with certain public reporting and proxy statement requirements thereunder. Compliance with these requirements is costly and time-consuming. We plan to initiate steps to exit from such reporting requirements in order to curtail expenses; however, such process may be protracted and we may be required to continue to file Current Reports on Form 8-K or other reports to disclose material events, including those related to the Dissolution. Accordingly, we will continue to incur expenses that will reduce the amount available for distribution, including expenses of complying with public company reporting requirements and paying its service providers, among others. If our reporting obligations cease, publicly available information about us will be substantially reduced.

Stockholders may not be able to recognize a loss for U.S. federal income tax purposes until they receive a final distribution from us.

As a result of the Dissolution, for U.S. federal income tax purposes, a stockholder that is a U.S. person generally will recognize gain or loss on a share-by- share basis equal to the difference between (1) the sum of the amount of cash and the fair market value of property, if any, distributed to the stockholder with respect to each share, less any known liabilities assumed by the stockholder or to which the distributed property (if any) is subject, and (2) the stockholder’s adjusted tax basis in each share of our common stock. A liquidating distribution pursuant to the Plan of Dissolution may occur at various times and in more than one tax year. Any loss generally will be recognized by a stockholder only in the tax year in which the stockholder receives our final liquidating distribution, and then only if the aggregate value of all liquidating distributions with respect to a share of our common stock is less than the stockholder’s tax basis for that share. Stockholders are urged to consult with their own tax advisors as to the specific tax consequences to them of the Dissolution pursuant to the Plan of Dissolution. See the section entitled “Proposal 1 — Approval of the Dissolution Pursuant to the Plan of Dissolution — Certain Material U.S. Federal Income Tax Consequences of the Proposed Dissolution” beginning on page 19 of this proxy statement.

The tax treatment of any liquidating distribution may vary from stockholder to stockholder, and the discussions in this proxy statement regarding tax consequences are general in nature.

We have not requested a ruling from the IRS with respect to the anticipated tax consequences of the Dissolution, and we will not seek an opinion of counsel with respect to the anticipated tax consequences of any liquidating distributions. If any of the anticipated tax consequences described in this proxy statement prove to be incorrect, the result could be increased taxation at the corporate or stockholder level, thus reducing the benefit to our stockholders and us from the Dissolution. Tax considerations applicable to particular stockholders may vary with and be contingent on the stockholder’s individual circumstances. You should consult your own tax advisor for tax advice instead of relying on the discussions of tax consequences in this proxy statement.

PROPOSAL 1 — APPROVAL OF THE DISSOLUTION PURSUANT TO THE PLAN OF DISSOLUTION

We are asking you to authorize and approve the Dissolution. Our Board has determined that the Dissolution is advisable and in the best interests of the Company and our stockholders, has approved the Dissolution and has adopted the Plan of Dissolution. The reasons for the Dissolution are described under “Proposal 1 — Approval of the Dissolution Pursuant to the Plan of Dissolution — Background of the Proposed Dissolution” beginning on page 11 of this proxy statement. The Dissolution requires approval by the holders of a majority of our outstanding common stock entitled to vote at the annual meetingSpecial Meeting that is the subject of this proxy statement. Our Board unanimously recommends that our stockholders authorize the Dissolution.

In general terms, when we dissolve, we will cease conducting our business, wind up our affairs, dispose of our non-cash assets, pay or otherwise provide for our obligations, and distribute our remaining assets, if any, during a post-dissolution period of at least three years, as required by the DGCL. With respect to the Dissolution, we will follow the dissolution and winding-up procedures prescribed by the DGCL, as described in further detail under “Proposal 1 — Approval of the Dissolution Pursuant to the Plan of Dissolution — Delaware Law Applicable to Our Dissolution” beginning on page 12 of this proxy statement. Our liquidation, winding up and distribution procedures will be further guided by our Plan of Dissolution, as described in further detail under “Proposal 1 — Approval of the Dissolution Pursuant to the Plan of Dissolution — Our Plan of Dissolution” beginning on page 15 of this proxy statement. You should carefully consider the risk factors relating to our complete liquidation and dissolution and described under “Risk Factors — Risks Related to The Dissolution” beginning on page 7 of this proxy statement.

Subject to the requirements of the DGCL and our Plan of Dissolution, as further described below, we will use our existing cash to pay for our winding up procedures, including:

| · | the costs associated with our Dissolution and winding up over the Survival Period; these costs may include, among others, expenses necessary to the implementation and administration of our Plan of Dissolution and fees and other amounts payable to professional advisors (including legal counsel, financial advisors and others) and to consultants and others assisting us with our Dissolution; |

| · | any claims by others against us that we do not reject as part of the dissolution process; |

| · | any amounts owed by us under contracts with third parties; |

| · | the funding of any reserves or other security we are required to establish, or deem appropriate to establish, to pay for asserted claims (including lawsuits) and possible future claims, as further described below; and |

| · | solely to the extent remaining after provision for the above-described payments, liquidating distributions to be made to our stockholders, which distributions may be made from time to time as available and in accordance with the DGCL procedures described below. |

ESTIMATED DISTRIBUTIONS TO STOCKHOLDERS

Based on currently available information, we estimate that we will have in the range between approximately $400,000 and $900,000 of cash that we will be able to distribute to stockholders in connection with the Dissolution, which implies a per share distribution range of $0.03 to $0.07 per share of common stock. Calculating such an estimate is inherently uncertain and requires that we make a number of assumptions regarding future events, many of which are unlikely to ultimately be true. We used the following assumptions when calculating the estimated distributable cash value: (i) approximately $700,000 payable for insurance, (ii) approximately $400,000 payable for wind-down administration services and retainage, (iii) approximately $200,000 payable for legal fees, (iv) approximately $300,000 payable for severance, (v) approximately $400,000 payable for wages, board fees and consultants, (vi) approximately $100,000 payable for accounting fees, (vii) approximately $100,000 payable for disposal of inventory, property and equipment and (viii) approximately $200,000 payable for other general and administrative costs.

Distributions, if any, to our stockholders may be paid in one or more distributions. Such distributions will not occur until after the Certificate of Dissolution is filed, and we cannot predict the timing or amount of any such distributions, as uncertainties as to the ultimate amount of our liabilities, the operating costs and amounts to be set aside for claims, obligations and provisions during the liquidation and winding-up process, and the related timing to complete such transactions make it impossible to predict with certainty the actual net cash amount that will ultimately be available for distribution to stockholders or the timing of any such distributions. Examples of uncertainties that could reduce the value of distributions to our stockholders include: unanticipated costs relating to the defense, satisfaction or settlement of existing or future lawsuits or other claims threatened against us or our officers or directors; amounts necessary to constituteresolve claims of our creditors; and delays in the liquidation and dissolution or other winding up of our subsidiaries due to our inability to settle claims or otherwise.

Our estimate of the anticipated initial distribution amounts is preliminary and many of the factors that are necessary to determine how much, if any, we will be able to distribute to our stockholders in liquidation are subject to change and outside of our control. While we intend to pursue matters related to our liquidation and winding up as quickly as possible if we obtain approval from our stockholders, the timing of many elements of this process after our Dissolution will not be entirely within our control and, therefore, we are unable to estimate when we would be able to begin making any post-Dissolution liquidating distributions to our stockholders. See the section entitled “Risk Factors — Risks Related to The Dissolution” beginning on page 7 of this proxy statement.

The description of the Dissolution contained in this introductory section is general in nature and is subject to various other factors and requirements, as described in greater detail below.

BACKGROUND OF THE PROPOSED DISSOLUTION

In the ordinary course from time to time, our Board and management team have evaluated and considered a quorumvariety of financial and strategic opportunities for the Company as part of our long-term strategy to enhance value for our stockholders, including potential acquisitions, divestitures, business combinations and other transactions.

Historically, we were a clinical-stage therapeutics company focused on developing innovative products to address significant unmet medical needs in the treatment of cardiopulmonary diseases. Our focus had primarily been the development of our nitric oxide therapy for patients with or at risk of pulmonary hypertension, or PH, using our proprietary pulsatile nitric oxide delivery platform, INOpulse.

On June 5, 2023, we issued a press release announcing top-line results from our pivotal Phase 3 REBUILD clinical trial evaluating the safety and efficacy of INOpulse. The trial did not meet its primary endpoint and the secondary endpoints demonstrated minimal difference between the two groups with none approaching statistical significance. Based on these findings, we decided to terminate the REBUILD Phase 3 clinical study and withdraw patients from all of our ongoing INOpulse development programs and disclosed our intention to explore a range of strategic alternatives to maximize stockholder value, including, but not limited to, a merger, a business combination, a sale of assets or other transaction or a liquidation and dissolution. We also began implementation of a Board-approved plan to preserve capital, reduce operating costs, and maximize the value of our assets. Consistent with our capital preservation efforts, we reduced our workforce except for certain executive officers and finance personnel required to lead the strategic review process and manage remaining operations.

Our Board and management consulted with advisors relating to the pursuit of a sale or merger of the Company, including a reverse merger. Despite broad canvassing and discussions with multiple potential strategic parties, we were unsuccessful in identifying and entering into agreements for any viable transactions.

In light of the strategic alternatives review, our Board determined that approving the Plan of Dissolution gives our Board the most flexibility in optimizing value for our stockholders and as a result, on October 12, 2023, our Board adopted resolutions approving the Plan of Dissolution and the Dissolution and recommending that our stockholders approve the Plan of Dissolution and the Dissolution.

REASONS FOR THE PROPOSED DISSOLUTION

The Board believes that the Dissolution is in the Company’s best interests and the best interests of our stockholders. The Board considered and pursued at length potential strategic alternatives available to the Company such as a merger, strategic partnership or other business combination transaction, and, following the results of such review, now believe that pursuing a wind-up of the Company in accordance with the Plan of Dissolution gives our Board the most flexibility in optimizing value for our stockholders.

In making its determination to approve the Dissolution, the Board considered, in addition to other pertinent factors, the fact that the Company currently has no significant remaining business operations or business prospects; the fact that the Company will continue to incur substantial accounting, legal and other expenses associated with being a public company despite having no source of revenue or financing alternatives; and the fact that the Company has conducted an evaluation to identify remaining strategic alternatives involving the Company, such as a merger, strategic partnership or other business combination transaction, that would have a reasonable likelihood of providing value to our stockholders in excess of the amount the stockholders would receive in a liquidation. As a result of its evaluation, the Board concluded that the Dissolution is the preferred strategy among the alternatives now available to the Company and is in the best interests of the Company and its stockholders. Accordingly, the Board approved the Dissolution of the Company pursuant to the Plan of Dissolution and recommends that our stockholders approve the Dissolution Proposal.

DELAWARE LAW APPLICABLE TO OUR DISSOLUTION

We are a corporation organized under the laws of the State of Delaware and the Dissolution will be governed by the DGCL. The following is a brief summary of some of the DGCL provisions applicable to the Dissolution. The following summary is qualified in its entirely by Sections 275 through 283 of the DGCL, which are attached to this proxy statement as Annex B.

Delaware Law Generally

Authorization of Board and Stockholders. If a corporation’s board of directors deems it advisable that the corporation should dissolve, it may adopt a resolution to that effect by a majority vote of the whole board and notify the corporation’s stockholders entitled to vote on the dissolution of the adoption of the resolution and the calling of a meeting of stockholders to act on the resolution. Our Board has unanimously adopted a resolution approving the Dissolution and the Plan of Dissolution and declaring them advisable and recommending them to our stockholders. The Dissolution must be authorized and approved by the holders of a majority of our outstanding common stock on the Record Date entitled to vote on the Dissolution Proposal.

Certificate of Dissolution. If a corporation’s stockholders authorize its dissolution, to consummate the dissolution the corporation must file a certificate of dissolution with the Secretary of State. If our stockholders authorize the Dissolution at the Special Meeting, we intend to file the Certificate of Dissolution with the Secretary of State as soon as practicable after the receipt of such approval. However, the timing of such filing is subject to the discretion of the Board.

Possible Permitted Abandonment of Dissolution. The resolution authorizing a dissolution adopted by a corporation’s board of directors may provide that, notwithstanding authorization of the dissolution by the corporation’s stockholders, the board of directors may abandon the dissolution without further action by the stockholders. While we do not currently foresee any reason that our Board would abandon our proposed Dissolution once it is authorized by our stockholders, to provide our Board with the maximum flexibility to act in the best interests of our stockholders, the resolutions adopted by our Board included language providing the board with the flexibility to abandon the Dissolution without further action of our stockholders at any time prior to the filing of the Certificate of Dissolution.

Time of Dissolution. When a corporation’s certificate of dissolution is filed with the Secretary of State and has become effective, along with the corporation’s tender of all taxes (including Delaware franchise taxes) and fees authorized to be collected by the Secretary of State, the corporation will be dissolved. We refer to the effective time of the Certificate of Dissolution herein as the “Effective Time.”

Continuation of Corporation After Dissolution

A dissolved corporation continues its existence for three years after dissolution, or such longer period as the Delaware Court of Chancery may direct, for the purpose of prosecuting and defending suits and enabling the corporation to settle and close its business, to dispose of and convey its property, to discharge its liabilities and to distribute to its stockholders any remaining assets. A dissolved corporation may not, however, continue the business for which it was organized. Any action, suit or proceeding begun by or against the corporation before or during this survival period does not abate by reason of the dissolution, and for the purpose of any such action, suit or proceeding, the corporation will continue beyond the Survival Period until any related judgments, orders or decrees are fully executed, without the necessity for any special direction by the Delaware Court of Chancery. Our Plan of Dissolution will govern our winding up process after Dissolution. See the section entitled “Proposal 1 — Approval of the Dissolution Pursuant to the Plan of Dissolution — Our Plan of Dissolution” beginning on page 15 of this proxy statement.

Payment and Distribution to Claimants and Stockholders

A dissolved corporation must make provision for the payment (or reservation of funds as security for payment) of claims against the corporation in accordance with the applicable provisions of the DGCL and the distribution of remaining assets to the corporation’s stockholders. The dissolved corporation may do this by following one of two procedures, as described below.

Safe Harbor Procedures under DGCL Sections 280 and 281(a) (the “Safe Harbor Procedures”)

A dissolved corporation may elect to give notice of its dissolution to persons having a claim against the corporation (other than claims against the corporation in any pending actions, suits or proceedings to which the corporation is a party) (“Current Claimants”) and to persons with contractual claims contingent on the occurrence or nonoccurrence of future events or otherwise conditional or unmatured (“Contingent Contractual Claimants”), and after giving these notices, following the procedures set forth in the DGCL, as described below.

The Plan of Dissolution provides the Board with the discretion to elect to follow the Safe Harbor Procedures rather than the Alternative Procedures.

Current Claimants

Notices and Publication. The notice to Current Claimants must state (1) that all such claims must be presented to the corporation in writing and must contain sufficient information reasonably to inform the corporation of the identity of the claimant and the substance of the claim; (2) the mailing address to which the claim must be sent; (3) the date (the “Claim Date”) by which the claim must be received by the corporation, which must be no earlier than 60 days from the date of the corporation’s notice; (4) that the claim will be barred if not received by the Claim Date; (5) that the corporation may make distributions to other claimants and the corporation’s stockholders without further notice to the Current Claimant; and (6) the aggregate annual meeting. Votes